Web Sales What’s It, Formulation, The Way To Calculate, Vs Internet Revenue

Understanding the idea of price of products offered (COGS) and its calculation will assist businesses in reducing their complete cost and calculate their gross revenue. Find out more in regards to the Value of Goods Offered formulation and examples right here. During inflation, the FIFO method assumes a business’s least expensive merchandise promote first. As prices enhance, the business’s net income could enhance as well. This process could end in a decrease value of goods sold calculation compared to the LIFO technique. Past that, monitoring accurate prices of your inventory helps you calculate your true stock value, or the entire dollar worth of inventory you have in stock.

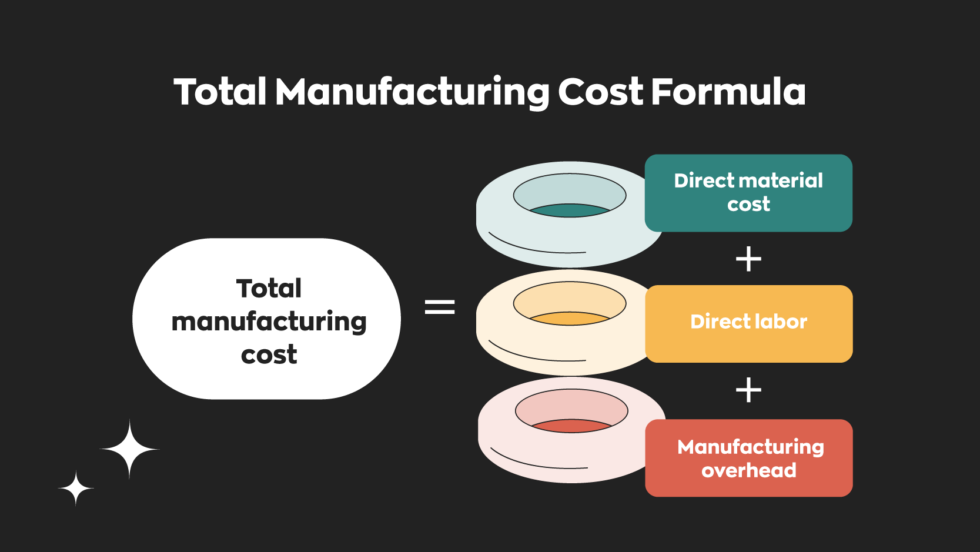

- The price of gross sales will embrace direct labor prices, direct supplies costs, and any production-related overhead prices.

- If the Cost Of Goods Offered will increase, the company’s internet revenue would lower.

- The built-in compliance lets you generate automated accounting and tax stories.

- By the end of September, the shop has £5,000 value of trainers left in inventory.

Revenues And Revenue

Understanding the value of goods bought (COGS) helps companies to search out out about their monetary well being and profitability. All companies need to trace direct or oblique prices incurred in getting their product prepared for sales in the market. For different business buildings, the deduction still applies but might be reported in several types similar to their tax filing requirements. The IRS tips on COGS enable businesses to incorporate the value of merchandise or uncooked supplies, direct labor prices involved in production, and factory overhead of their calculations. In value accounting, supplies and provides and direct labor are mixed, and represent what is named prime cost.

What Costs Are Included In Cogs?

The gross margin is calculated by deducting the company’s cost of goods offered (COGS)from the net what is cost of sales in income statement sales revenue. That might include the price of raw supplies, cost of time and labor, and the cost of working gear. Selling the merchandise creates a revenue, but a portion of that revenue was lost, as a outcome of the price of making the merchandise. You can discover your cost of goods sold on your small business revenue assertion. An income statement details your company’s earnings or losses over a period of time, and is amongst the major monetary statements.

The Way To Account For The Price Of Sales

These expenses can embody interest payments on loans, taxes, and other prices that don’t directly relate to producing items or services. Operating revenue, also called operating earnings or operating loss, is the distinction between total revenues and complete working bills. Organizations can analyze their financial well being, make strategic strikes, and ensure regular progress via a Assertion of Operations.

Information Wanted To Calculate The Price Of Goods Sold(cogs)

Operating bills embrace costs similar to advertising and advertising, office rent, administrative salaries, and analysis and growth expenditures. These expenses are generally more fastened in nature in comparability with Cost of Gross Sales https://www.kelleysbookkeeping.com/, which means they do not necessarily change with the level of production or gross sales. On a regular revenue assertion, Value of Gross Sales is positioned immediately below “Revenue” or “Sales Income.” This highlights its immediate relationship to the money a company brings in.

Price of Items Sold could be discovered on a company’s income assertion and is listed as a direct enterprise expense. The common cost valuation methodology considers the typical price of all the goods in stock, regardless of its buying time. Contemplating the common value prevents COGS from being impacted a lot by the excessive cost of some stock items. In Accordance to Final In, First Out (LIFO) valuation technique, the final items added to the stock are sold first in the market. As the prices mainly tend to extend over time, inventory objects with greater cost prices are bought first available within the market, which leads to the next COGS quantity. The value of labor consists of the direct labor cost incurred in producing or manufacturing the ultimate product.